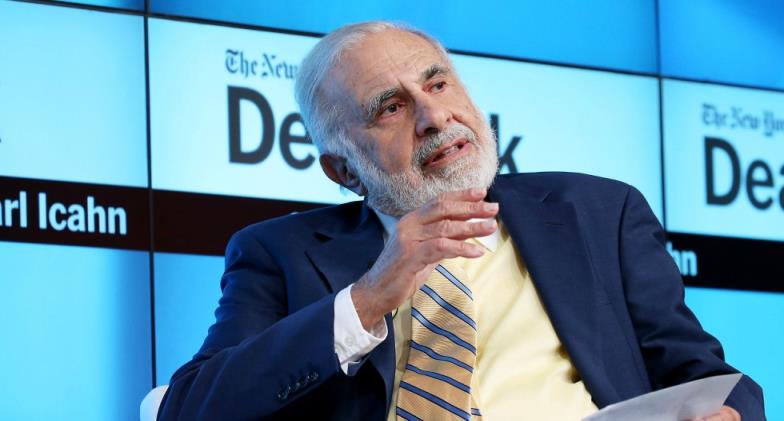

The impact of Carl Icahn on corporate governance is undeniable. Icahn is renowned for his activist investments and shareholder activism, which has had a positive effect on corporate governance biooverview. Icahn’s approach to corporate governance has always been to maximize shareholder value and to create shareholder-friendly corporate structures. He has done this through a variety of tactics such as public criticism, proxy fights, and mergers and acquisitions. He has also taken an active role in management decisions, often taking control of companies and forcing them to implement changes to their corporate structures. Perhaps Icahn’s most significant contribution to corporate governance is the way in which he has promoted the concept of independent directors. Icahn has been a proponent of the idea that independent directors should be part of a company’s board of directors, helping to ensure that management is acting in the best interests of the shareholders. This concept has been embraced by many corporate boards and has had a positive effect on corporate governance. Icahn has also been active in fighting against corporate malfeasance. He has taken on a number of high-profile cases, and has often forced companies to take corrective action to prevent future misconduct. He has been involved in the prosecution of several executives who have been charged with fraud and other corporate crimes. Overall, Carl Icahn has had a positive impact on corporate governance. His activism and shareholder-friendly approach has ensured that companies are held accountable for their actions, and that their corporate structures are designed to benefit shareholders. His contributions to corporate governance have been invaluable, and his influence will continue to be felt for years to come scoopkeeda.

Carl Icahn is one of the most well-known and successful corporate raiders and activist investors in the world. An activist investor is an individual or group that purchases a large number of shares in a publicly traded company in order to influence the company’s management and operations. Icahn has used his vast wealth to become a major shareholder in numerous companies and has a reputation for pushing for major changes in corporate governance and management. His activism has been both praised and criticized. Icahn has been praised for his ability to invest in undervalued companies, sometimes turning them into profitable entities. His activism has also been credited with forcing companies to become more efficient and accountable to shareholders. Icahn is known for pushing for changes such as restructuring debt, selling off assets, and engaging in cost-cutting measures. Critics of Icahn’s activism point out that he often uses his influence to benefit himself at the expense of other shareholders. Icahn has been accused of taking advantage of his position to win board seats, acquire debt at below-market rates, and force other shareholders to accept deals that are not in their best interest. In addition, some argue that Icahn’s aggressive tactics can be detrimental to companies, as they can lead to mismanagement and decreased shareholder value. Icahn’s activism has also been criticized for its short-term focus. Icahn often pushes for changes that will increase a company’s stock price in the short term, but may not be beneficial to the long-term health of the company. He has also been accused of using his influence to pressure companies into making decisions that are beneficial to him, but not to other shareholders. Despite the criticism, Icahn’s activism has been credited with forcing companies to become more efficient and accountable to shareholders. Icahn’s success has made him a powerful figure in the world of corporate governance, and his influence has been felt throughout the wotpost.